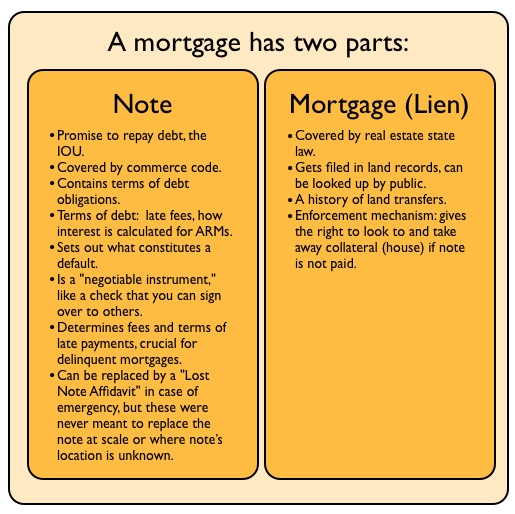

But first, let’s define what a mortgage is. A mortgage consists of two documents, a note and a lien:

The note is the IOU, it’s the borrower’s promise to pay. The mortgage, or the lien, is just the enforcement right to take the property if the note goes unpaid. The note is crucial.For Distressed Homeowners

The second is that it also matters a great deal for homeowners who are distressed. The note lays out the terms of late fees and other penalties. As we will discuss in the next section about mortgage servicers, the process of trying to get people behind on their payments current instead of driving them into bankruptcy has broken down. But for now it’s clear that mortgage servicers don’t have great incentives to get distressed homeowner’s records correct.

There’s well-documented evidence that extra fees are tacked on to mortgages that have fallen behind, fees that aren’t following the terms of the note. This is usually only found out in bankruptcy where there is a lawyer (and multiple parties), not in foreclosure cases. But if homeowners wants to challenge whether what the servicers claim is the correct final due amount, the terms of the note are necessary for the court.

This will matter a great deal for many homeowners. Small, marginal differences in the total owed could allow for a short sale. It could determine if the homeowner has any equity in their home. And this can only be determined by producing the note.

Last reason: you can tell it’s important because all the smartest finance guys in the room thought it was important. Let’s look at a Pooling and Service Agreement form from 2006 between “GS MORTGAGE SECURITIES CORP., Depositor, and DEUTSCHE BANK NATIONAL TRUST COMPANY, Trustee.” (h/t Adam Levitin for this example.) Let’s reproduce the chart from part 1 to see the chain between depositors and trustees who oversee the trust:

No comments:

Post a Comment