From Naked Capitalism website:

We were already very unhappy about the fact that the review was conducted on 2800 mortgage files across 14 servicers and there seemed to be no scientific process for how the cases were selected. The GAO signaled it had reservations about the exercise. And no wonder. Not only was it a garbage-in, garbage out process (whether the borrowers were delinquent was based on the servicers’ say so, not any analysis to see if the fees, charges, and applications of payments were in compliance with the law and the various agreements), it effectively said pretty much all foreclosures were warranted when it looked at only 100 completed foreclosures:

Federal Deposit Insurance Corp. Chairman Sheila Bair said in a Senate committee hearing this week that these reviews will be a major issue. The investigation conducted by the OCC and the Fed included a review of just 100 foreclosure files.

No wonder Bair felt compelled to distance herself from this regulatory theater. It isn’t just pathetic, it’s the regulators thumbing their noses at the public.

"In seeking truth you have to get both sides of a story.---And that's the way it is."--Walter Cronkite

Saturday, May 14, 2011

Fraudclosure whistleblowers speak out against loan mods that helped banks not homeowners

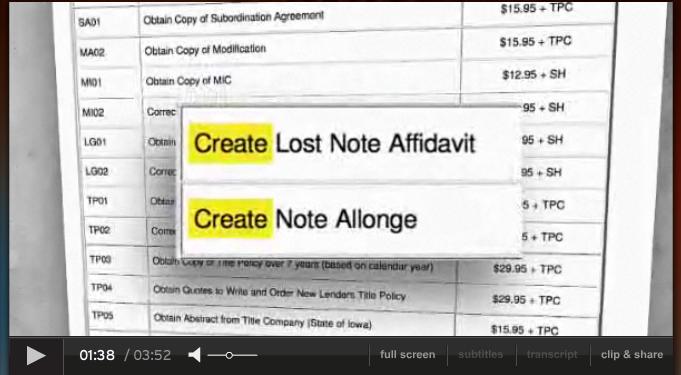

A report at the Dylan Ratigan show confirms what is not surprising for some time is happening: that banks are not making mods to viable borrowers because servicing is more profitable. In addition, an insider and whistleblower for Fannie Mae on the HAMP program says that the pressure to make trial mods to make the program look good wound up hurting people.

Be sure to watch to the end to see how Goldman Sachs threatened one of the whistleblowers which by the way never mentioned the name of company that he worked for:

Be sure to watch to the end to see how Goldman Sachs threatened one of the whistleblowers which by the way never mentioned the name of company that he worked for:

Visit msnbc.com for breaking news, world news, and news about the economy

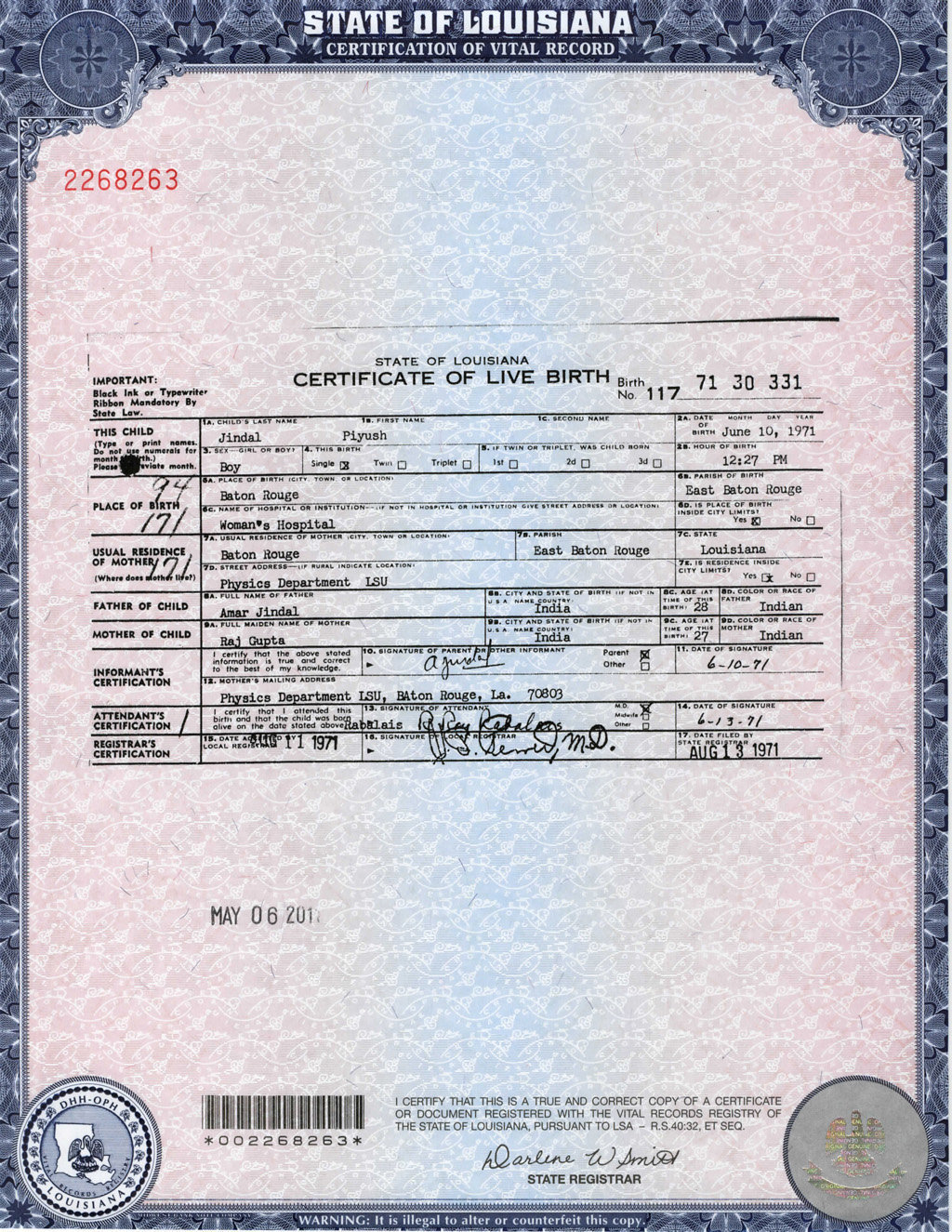

Deutsche Bank Sues Foreclosure Fraud Expert Lynn Szymoniak's Son With No Financial Interest In Her Case

This is a clear case of retaliation....

After she’d been sued, Szymoniak said, she began investigating the documentation on Florida foreclosures, uncovering alarming irregularities, including signatures that were apparently forged. If so, those signatures allowed banks to push foreclosures through overly quickly, charge improper fees and assert improperly inflated borrower debts.

Shortly after appearing on “60 Minutes” Szymoniak won a major victory in her own foreclosure case. The court found that Deutsche Bank was unable to demonstrate ownership of her mortgage, which had originally been issued by the defunct subprime mortgage lender Option One, and threw the case out.

Deutsche Bank was permitted to refile their case if they could obtain proper documentation, however. And on Friday, May 6, Szymoniak received a notification from the bank’s lawyers that she was again being sued for foreclosure.

But Deutsche Bank wasn’t just going after her. The bank was also attempting to sue her son, Mark Cullen, who is currently pursuing a graduate degree in poetry at the New School in New York. Cullen hasn’t lived in Szymoniak’s house for seven years and is not a party to any aspect of her mortgage — he has no interest in either the property or the loan, and never has had any such interest, according to Szymoniak.

“It is just absolute harassment,” Szymoniak said. “He doesn’t own anything, for god’s sake! He’s getting a masters in poetry. He not only doesn’t have any money, he’s never going to have any money.”

After she’d been sued, Szymoniak said, she began investigating the documentation on Florida foreclosures, uncovering alarming irregularities, including signatures that were apparently forged. If so, those signatures allowed banks to push foreclosures through overly quickly, charge improper fees and assert improperly inflated borrower debts.

Shortly after appearing on “60 Minutes” Szymoniak won a major victory in her own foreclosure case. The court found that Deutsche Bank was unable to demonstrate ownership of her mortgage, which had originally been issued by the defunct subprime mortgage lender Option One, and threw the case out.

Deutsche Bank was permitted to refile their case if they could obtain proper documentation, however. And on Friday, May 6, Szymoniak received a notification from the bank’s lawyers that she was again being sued for foreclosure.

But Deutsche Bank wasn’t just going after her. The bank was also attempting to sue her son, Mark Cullen, who is currently pursuing a graduate degree in poetry at the New School in New York. Cullen hasn’t lived in Szymoniak’s house for seven years and is not a party to any aspect of her mortgage — he has no interest in either the property or the loan, and never has had any such interest, according to Szymoniak.

“It is just absolute harassment,” Szymoniak said. “He doesn’t own anything, for god’s sake! He’s getting a masters in poetry. He not only doesn’t have any money, he’s never going to have any money.”

Read the rest here…

Independent reviews in mortgage servicer consent orders to stay sealed

When mortgage servicers signed consent orders with the Office of the Comptroller of the Currency and the Federal Reserve, these companies were required to hire outside firms to conduct "look back" evaluations of questionable foreclosure practices.

But these reviews will not be made public, according to an OCC spokesman.

Major servicing arms at Bank of America (BAC: 11.93 -2.21%), JPMorgan Chase (JPM: 43.15 -2.13%), Wells Fargo (WFC: 27.93 -1.06%), Citigroup (C: 41.53 -2.10%), Ally Financial (GJM: 24.1601 -0.08%) and others agreed to the enforcement actions taken in April as a result of mishandled foreclosures still being corrected.

Servicers have to put in place new operations, add staff, establish a single-point of contact for borrowers and end the practice of pursuing a foreclosure while evaluating a possible modification.

The banks were also required to hire third-party firms to review foreclosure proceedings between Jan. 1, 2009 and Dec. 31, 2010. The reviews will be done to identify borrowers who suffered financial harm because of faulty foreclosure practices. The OCC and Fed will approve which companies conduct the reviews.

Read on.

But these reviews will not be made public, according to an OCC spokesman.

Major servicing arms at Bank of America (BAC: 11.93 -2.21%), JPMorgan Chase (JPM: 43.15 -2.13%), Wells Fargo (WFC: 27.93 -1.06%), Citigroup (C: 41.53 -2.10%), Ally Financial (GJM: 24.1601 -0.08%) and others agreed to the enforcement actions taken in April as a result of mishandled foreclosures still being corrected.

Servicers have to put in place new operations, add staff, establish a single-point of contact for borrowers and end the practice of pursuing a foreclosure while evaluating a possible modification.

The banks were also required to hire third-party firms to review foreclosure proceedings between Jan. 1, 2009 and Dec. 31, 2010. The reviews will be done to identify borrowers who suffered financial harm because of faulty foreclosure practices. The OCC and Fed will approve which companies conduct the reviews.

Read on.

Biloxi Buzz for Saturday

George W. Bush Breaks Silence Over Bin Laden's Death

Ron Paul Announces Presidential Campaign

Did John Boehner Break The Law?

High schooler challenges Bachmann to debate on U.S. Constitution — A high school sophomore from New Jersey is challenging Rep. Michele Bachmann to a debate on civics and the U.S. Constitution. In an open letter to to Bachmann, Amy Myers of Cherry Hill, N.J., said, “I have found quite a few …

Friday, May 13, 2011

Open thread for Friday

Message from SP Biloxi:

As you may notice, all of Thursday's postings are gone. Blogger was down all day yesterday and apparently all of my postings have disappeared. I only hope that the postings will return. My apologies.

As you may notice, all of Thursday's postings are gone. Blogger was down all day yesterday and apparently all of my postings have disappeared. I only hope that the postings will return. My apologies.

KPHO Channel 5 Arizona Airs Story on Rep. Seel’s Questionable Principal Reduction

Mandelman Matters - 5/13/2011

<$nip>

Well, if you remember the story on Mandelman Matters last week about Arizona’s Rep. Carl Seel who received roughly a $100,000 PRINCIPAL REDUCTION on his $190,000 mortgage two days before he was to introduce an amendment to a bill that would have helped protect Arizona’s homeowners from losing homes to foreclosure by requiring mortgage servicers to declare that there was a proper chain of title before being allowed to foreclose, then you’ll want to watch this Channel 5 News story.

Spolier Alert: Rep. Seel, who wonder of wonders… serves on the… wait for it… BANKING AND INSURANCE COMMITTEE… DENIES that his $100,000 principal reduction had anything to do with his decision to run late that day and not propose the pre-foreclosure chain of title amendment as he had planned to do just days before… that’s right… HE DENIES IT!

That’s right… the two events… the $100,000 principal reduction he got 2 days before he decided not to propose the amendment are not related according to Rep. Seel. The story is only a few minutes long but it’s worth it just to see him deny the whole thing… classic.

Senators introduce bill to establish mortgage servicing standards

Sen. Olympia Snow (R-Maine) and Sen. Jeff Merkley (D-Ore.) introduced legislation Thursday establishing federal standards for mortgage servicers.

S.967, or the Regulation of Mortgage Servicing Act, would require servicers to create a single-point of contact for borrowers and end dual-tracking of pursuing foreclosure and loan modification simultaneously. The bill also requires third-party review of servicers' actions before foreclosure.

Both Snowe and Merkley said their offices have been overwhelmed with calls from borrowers confused and frustrated with the process.

Read on.

S.967, or the Regulation of Mortgage Servicing Act, would require servicers to create a single-point of contact for borrowers and end dual-tracking of pursuing foreclosure and loan modification simultaneously. The bill also requires third-party review of servicers' actions before foreclosure.

Both Snowe and Merkley said their offices have been overwhelmed with calls from borrowers confused and frustrated with the process.

Read on.

PBC Clerk of Court Sharon Bock to County Citizens RE Fraudclosures, It’s Not My Problem

Officials from several states are pulling court documents bearing the name of the now infamous robo-signer Linda Green following a 60 Minutes exposé on foreclosure fraud that featured a Palm Beach County homeowner.

In Michigan, Massachusetts and North Carolina registers of deeds have combed through filings looking for Green, documenting irregularities in signatures and forwarding their findings to law enforcement, federal regulators and attorneys general.

In Palm Beach County, a spokeswoman for Clerk of Court Sharon Bock said the Linda Green issue does not fall under “our purview to investigate or take action.”

“The clerk does not have authority under the statute to question the validity of a signature on a document presented for recording,” said spokeswoman Julie Nicholas.

“It is the role of the home¬owners and/or attorneys representing homeowners to raise any legal issues that they believe may assist a home¬owner in a foreclosure case.“

You can check out the rest over at the Palm Beach Post here…

In Michigan, Massachusetts and North Carolina registers of deeds have combed through filings looking for Green, documenting irregularities in signatures and forwarding their findings to law enforcement, federal regulators and attorneys general.

In Palm Beach County, a spokeswoman for Clerk of Court Sharon Bock said the Linda Green issue does not fall under “our purview to investigate or take action.”

“The clerk does not have authority under the statute to question the validity of a signature on a document presented for recording,” said spokeswoman Julie Nicholas.

“It is the role of the home¬owners and/or attorneys representing homeowners to raise any legal issues that they believe may assist a home¬owner in a foreclosure case.“

You can check out the rest over at the Palm Beach Post here…

Erin Collins Cullaro, Pam Bondi’s AAG FIRED for “Moonlighting” at Foreclosure Mill, Florida Default Law Group

TAMPA — The attorney general’s office has fired Erin Cullaro, an assistant Florida attorney general reprimanded last year for moonlighting for a “foreclosure mill.”

The termination follows a second reprimand in March from Gov. Rick Scott’s office, which questioned variations of her signature on legal documents.

The signature that was used to notarize affidavits of “reasonable attorney fees” is not the same signature she was commissioned to use, according to a letter from Scott’s office.

The April termination came from the office of Attorney General Pam Bondi. Jenn Meale, communications director for Bondi’s office, said “when the management team reviewed its personnel, they decided to terminate (Cullaro’s) employment.” Meale offered no further explanation.

Ricardo A. Roig, a Tampa lawyer who represents Cullaro, said “there is no evidence of wrongdoing.”

“There’s no question Erin complied with the spirit and the letter of the law,” Roig said. “There are differences in her signatures, but a lot of people change the way they sign their name.”

You can check out the rest of the report here…

The termination follows a second reprimand in March from Gov. Rick Scott’s office, which questioned variations of her signature on legal documents.

The signature that was used to notarize affidavits of “reasonable attorney fees” is not the same signature she was commissioned to use, according to a letter from Scott’s office.

The April termination came from the office of Attorney General Pam Bondi. Jenn Meale, communications director for Bondi’s office, said “when the management team reviewed its personnel, they decided to terminate (Cullaro’s) employment.” Meale offered no further explanation.

Ricardo A. Roig, a Tampa lawyer who represents Cullaro, said “there is no evidence of wrongdoing.”

“There’s no question Erin complied with the spirit and the letter of the law,” Roig said. “There are differences in her signatures, but a lot of people change the way they sign their name.”

You can check out the rest of the report here…

Legal Morass: Anonymous sources say on-site ‘third-party auditors ID to probe Chase are from SEC

A repost from Thursday. Apparently, Blogger lost all of my Thursday's postings.

An update from Legal Morass website about JP Morgan Chase Credit Card Division:

UPDATE, 12 May 2011: Several sources, all anonymous, identify these ‘Third-party auditors’ as investigators/auditors from the Securities and Exchange Commission. On-site investigation/audit of JP Morgan Chase Credit Card Division(s) began on 03 May 2011.

Read more on the firings of Chase attorneys in connection to the Credit Card Division here.

An update from Legal Morass website about JP Morgan Chase Credit Card Division:

UPDATE, 12 May 2011: Several sources, all anonymous, identify these ‘Third-party auditors’ as investigators/auditors from the Securities and Exchange Commission. On-site investigation/audit of JP Morgan Chase Credit Card Division(s) began on 03 May 2011.

Read more on the firings of Chase attorneys in connection to the Credit Card Division here.

Thursday, May 12, 2011

Legal Morass: Anonymous sources ID on-site 'third-party auditors’ to Chase Credit Card Division are from SEC

As you may recall, Legal Morass reported that JP Morgan Chase attorneys were terminated for their involvement within the Chase/DebtOne consumer credit card portfolio and an unidentified regulator was paying the Chase Credit Card Division a visit. Click here to read the story. Well, looks like auditors paid a visit to them. More from Legal Morass:

UPDATE, 12 May 2011: Several sources, all anonymous, identify these ‘Third-party auditors’ as investigators/auditors from the Securities and Exchange Commission. On-site investigation/audit of JP Morgan Chase Credit Card Division(s) began on 03 May 2011.

UPDATE, 12 May 2011: Several sources, all anonymous, identify these ‘Third-party auditors’ as investigators/auditors from the Securities and Exchange Commission. On-site investigation/audit of JP Morgan Chase Credit Card Division(s) began on 03 May 2011.

NBC Nightly News: Foreclosure docs, mistakes and fakes (video)

Great reporting by Lisa Myers in Florida. Open thread.

Visit msnbc.com for breaking news, world news, and news about the economy

Wednesday, May 11, 2011

Keller Rohrback LLP. Announces Class Actions Filed In California Against SunTrust Mortgage, Inc. and Chase Home Finance LLC

SEATTLE, May 11, 2011 (GlobeNewswire) – Attorney Advertising. Keller Rohrback L.L.P. (www.krclassaction.com) announces the filings of two class action lawsuits in the United States District Court for the Southern District of California. One case was filed against SunTrust Mortgage, Inc. and SunTrust Banks, Inc. (NYSE: STI). The other case was filed against Chase Home Finance LLC and JPMorgan Chase Bank, N.A. (NYSE: JPM). The complaints were filed on behalf of California homeowners who have pursued mortgage loan modifications with SunTrust or Chase, and allege that the Defendants violated California consumer protection laws and breached contracts and other duties by, among other things:

Taking advantage of mortgagors’ defaults;

Verbally promising modification and forbearance, soliciting modification applications, and representing that certain written materials are part of the modification process;

Failing to grant promised modifications or reneging on contractual modifications;

Unduly delaying modifications;

Repeatedly telling mortgagors that documents are lost, missing, incomplete, or otherwise defective;

Proceeding with foreclosures based on mortgagors’ failure to meet shifting demands;

Increasing principal balances and imposing late charges and other fees and expenses on mortgagors;

Hanging foreclosure over mortgagors’ heads as they are dragged through the modification process;

Substantially increasing debts by incorrectly applying payments; and

Failing to keep accurate records.

Keller Rohrback’s investigation of the practices alleged in the complaints is ongoing, particularly regarding homeowners whose houses were sold in foreclosure sales after they tried to have their loans modified by SunTrust or Chase.

Read on

Taking advantage of mortgagors’ defaults;

Verbally promising modification and forbearance, soliciting modification applications, and representing that certain written materials are part of the modification process;

Failing to grant promised modifications or reneging on contractual modifications;

Unduly delaying modifications;

Repeatedly telling mortgagors that documents are lost, missing, incomplete, or otherwise defective;

Proceeding with foreclosures based on mortgagors’ failure to meet shifting demands;

Increasing principal balances and imposing late charges and other fees and expenses on mortgagors;

Hanging foreclosure over mortgagors’ heads as they are dragged through the modification process;

Substantially increasing debts by incorrectly applying payments; and

Failing to keep accurate records.

Keller Rohrback’s investigation of the practices alleged in the complaints is ongoing, particularly regarding homeowners whose houses were sold in foreclosure sales after they tried to have their loans modified by SunTrust or Chase.

Read on

Republican Lawmakers Offer Disaster Victims Prayers, But Not Federal Aid

Oh yes this is true...

WASHINGTON -- Republican lawmakers have been quick to rush to the assistance of disaster victims with that priceless commodity, prayer, but when it comes to tangible assets, they've been a bit less spirited.

An email circulated by the office of Rep. Randy Neugebauer (R-Tex.) and obtained by The Huffington Post asked lawmakers to co-sponsor H. Res 254, a straightforward measure encouraging Congress and the American public to pray for the victims of the recent disasters in the United States.

From the email sent out to congressional offices on Tuesday:

Severe tornadoes and record amounts of flooding in the South, Southeast, and lower Midwest have taken hundreds of lives and caused thousands of injuries. Property damage could reach into the billions of dollars, uprooting entire communities throughout the region.

The Southern Plains, lower Mississippi Valley, and Southwest have been experiencing the worst drought conditions in decades, leading to wildfires that have burned more than 2.2 million acres and caused massive losses in agricultural production. These wildfires have resulted in deaths, the destruction of homes and business, and severe financial hardship.

Many communities have been devastated by these disasters, but have maintained a spirit of resiliency, hope, and faith. It is only appropriate that Congress and the American people come together in prayer for the victims of the disasters and their families, and for the fair weather conditions that these regions desperately need.

WASHINGTON -- Republican lawmakers have been quick to rush to the assistance of disaster victims with that priceless commodity, prayer, but when it comes to tangible assets, they've been a bit less spirited.

An email circulated by the office of Rep. Randy Neugebauer (R-Tex.) and obtained by The Huffington Post asked lawmakers to co-sponsor H. Res 254, a straightforward measure encouraging Congress and the American public to pray for the victims of the recent disasters in the United States.

From the email sent out to congressional offices on Tuesday:

Severe tornadoes and record amounts of flooding in the South, Southeast, and lower Midwest have taken hundreds of lives and caused thousands of injuries. Property damage could reach into the billions of dollars, uprooting entire communities throughout the region.

The Southern Plains, lower Mississippi Valley, and Southwest have been experiencing the worst drought conditions in decades, leading to wildfires that have burned more than 2.2 million acres and caused massive losses in agricultural production. These wildfires have resulted in deaths, the destruction of homes and business, and severe financial hardship.

Many communities have been devastated by these disasters, but have maintained a spirit of resiliency, hope, and faith. It is only appropriate that Congress and the American people come together in prayer for the victims of the disasters and their families, and for the fair weather conditions that these regions desperately need.

CFPB begins design of new mortgage disclosure forms

Housingwire:

Over the next few months, the Consumer Financial Protection Bureau will begin revising and posting drafts of new mortgage disclosure forms lenders will be required to provide.

The Dodd-Frank Act mandates the new federal agency to combine the Truth in Lending Act and Real Estate Settlement Procedures Act forms for borrowers to better understand terms of a mortgage. The agency is required to issue a proposal within 18 months of opening, which is scheduled for July 21. However, lawmakers continue to spar over how the agency will operate and who will lead it.

The CFPB is meeting with other regulators, researchers, industry representatives, graphic designers and consumer advocates, as it tinkers with the design of the disclosure forms, versions of which will be available on its website.

Over the next few months, the Consumer Financial Protection Bureau will begin revising and posting drafts of new mortgage disclosure forms lenders will be required to provide.

The Dodd-Frank Act mandates the new federal agency to combine the Truth in Lending Act and Real Estate Settlement Procedures Act forms for borrowers to better understand terms of a mortgage. The agency is required to issue a proposal within 18 months of opening, which is scheduled for July 21. However, lawmakers continue to spar over how the agency will operate and who will lead it.

The CFPB is meeting with other regulators, researchers, industry representatives, graphic designers and consumer advocates, as it tinkers with the design of the disclosure forms, versions of which will be available on its website.

Billionaire hedge fund manager guilty on all counts

In what has been a heavily-watched insider trading case, Galleon Group hedge fund manager Raj Rajaratnam has been found guilty on all 14 counts of securities fraud and conspiracy, according to multiple reports. The announcement was made in a lower Manhattan federal court.

For now, Rajaratnam, who ran one of the world's largest hedge funds, will be free on bail, but will be fitted with an electronic monitoring device.

Rajaratnam was expressionless during the verdict reading by a courtroom deputy.

He could face 15-1/2 to 19-1/2 years in a federal prison under sentencing guidelines, prosecutors said.

The Manhattan federal jury announced its unanimous verdict on the 12th day of deliberations in what many legal experts said was a strong prosecution case using FBI phone taps and testimony of three former friends and associates of Rajaratnam.

The jury convicted Rajaratnam of nine counts of securities fraud and five counts of conspiracy for what prosecutors describe as the money manager's central role in the most sweeping probe of insider trading at hedge funds on record.

During the two-month trial, prosecutors hammered at their argument that Rajaratnam cheated to gain an unfair advantage in the stock market from 2003 to March 2009, reaping an illicit $63.8 million.

Defense lawyers had stuck consistently to their main theme that Rajaratnam's trades were guided by a trove of research and public information, not secrets leaked by highly-placed corporate insiders.

Sri Lankan-born Rajaratnam, 53, was ordered to be fitted with an electronic monitoring device while out on bail.

Prosecutors had asked the judge to jail Rajaratnam pending sentencing, but the judge rejected that request.

The case is USA v Raj Rajaratnam et al, U.S. District Court for the Southern District of New York, No. 09-01184.

For now, Rajaratnam, who ran one of the world's largest hedge funds, will be free on bail, but will be fitted with an electronic monitoring device.

Reuters has more on the Rajaratnam verdict:

Rajaratnam, a one-time billionaire, will remain free on bail until sentencing on July 29, U.S. District Judge Richard Holwell ruled after the jury delivered its verdict. Rajaratnam was expressionless during the verdict reading by a courtroom deputy.

He could face 15-1/2 to 19-1/2 years in a federal prison under sentencing guidelines, prosecutors said.

The Manhattan federal jury announced its unanimous verdict on the 12th day of deliberations in what many legal experts said was a strong prosecution case using FBI phone taps and testimony of three former friends and associates of Rajaratnam.

The jury convicted Rajaratnam of nine counts of securities fraud and five counts of conspiracy for what prosecutors describe as the money manager's central role in the most sweeping probe of insider trading at hedge funds on record.

During the two-month trial, prosecutors hammered at their argument that Rajaratnam cheated to gain an unfair advantage in the stock market from 2003 to March 2009, reaping an illicit $63.8 million.

Defense lawyers had stuck consistently to their main theme that Rajaratnam's trades were guided by a trove of research and public information, not secrets leaked by highly-placed corporate insiders.

Sri Lankan-born Rajaratnam, 53, was ordered to be fitted with an electronic monitoring device while out on bail.

Prosecutors had asked the judge to jail Rajaratnam pending sentencing, but the judge rejected that request.

The case is USA v Raj Rajaratnam et al, U.S. District Court for the Southern District of New York, No. 09-01184.

HSBC Continues Freeze On Home Seizures

HSBC North America Holdings, the ninth-largest U.S. bank by assets, told investors Wednesday that the bank's moratorium on home seizures continues in some jurisdictions and it will be "a number of months" before the bank fully resumes foreclosing on defaulted borrowers.

The lender did not specify in filings with federal regulators where it continues to restrict home repossessions or how many borrowers have been affected. HSBC handles more than 892,000 home loans, making it the 12th-largest mortgage servicer in the U.S., according to the Federal Reserve

Read on.

The lender did not specify in filings with federal regulators where it continues to restrict home repossessions or how many borrowers have been affected. HSBC handles more than 892,000 home loans, making it the 12th-largest mortgage servicer in the U.S., according to the Federal Reserve

Read on.

Foreclosures Create Dangerous Situations, Make Banks into Slumlord Millionaires

A fire that killed three people in the Bronx revealed the dangers of illegally subdivided apartments, but what is less widely known is the building's cloudy ownership status.

At dispute is a question over who was actually responsible for maintaining the property.

For at least three years, banks had been buying and selling the mortgage in a protracted foreclosure, while neighbors watched squatters move in.

“The banks’ story is it doesn’t concern them when there are squatters or illegal activity but they’re constantly aware, because I’ve called them and others have as well," said neighbor Chancy Marsh, who lives next door.

It is the latest plague of the housing crisis.

Banks that made foolish loans foreclose only to find themselves "slumlord millionaires," or lenders that took blighted and often dangerous properties away from distressed mortgage holders.

Read on.

At dispute is a question over who was actually responsible for maintaining the property.

For at least three years, banks had been buying and selling the mortgage in a protracted foreclosure, while neighbors watched squatters move in.

“The banks’ story is it doesn’t concern them when there are squatters or illegal activity but they’re constantly aware, because I’ve called them and others have as well," said neighbor Chancy Marsh, who lives next door.

It is the latest plague of the housing crisis.

Banks that made foolish loans foreclose only to find themselves "slumlord millionaires," or lenders that took blighted and often dangerous properties away from distressed mortgage holders.

Read on.

Leading Mortgage Firms May Be Forced To Reduce Loan Balances For Distressed Homeowners

The nation's five largest mortgage firms may be forced to reduce loan balances for distressed homeowners as part of an agreement with state attorneys general and the Obama administration to settle claims of faulty mortgage practices, a top state official involved in the negotiations said Tuesday.

The proposal is part of a set of remedies banks would have to agree to in order to settle the state and federal probes launched last autumn, which found that the largest mortgage firms illegally seized the homes of at least dozens of borrowers and engaged in shoddy practices that short-changed troubled borrowers.

Mortgage principal reductions would comprise part of a larger fine levied on Bank of America, JPMorgan Chase, Citigroup, Wells Fargo and Ally Financial. Penalties could reach $30 billion, officials said.

Read on.

On a side note: Chase, BofA, and other banks said to offer $5 Billion to resolve probe of foreclosures. Click here to read more.

The proposal is part of a set of remedies banks would have to agree to in order to settle the state and federal probes launched last autumn, which found that the largest mortgage firms illegally seized the homes of at least dozens of borrowers and engaged in shoddy practices that short-changed troubled borrowers.

Mortgage principal reductions would comprise part of a larger fine levied on Bank of America, JPMorgan Chase, Citigroup, Wells Fargo and Ally Financial. Penalties could reach $30 billion, officials said.

Read on.

On a side note: Chase, BofA, and other banks said to offer $5 Billion to resolve probe of foreclosures. Click here to read more.

Brookstone Law PC’s Lawsuit Against JP Morgan Shows Recent Bank Executives’ Email Revelations

Public disclosure of profanity-laced emails indicating senior executives of Bear Stearns and JP Morgan were aware of the toxic quality of mortgage loans they were selling homeowners are among several revelations alleged in a lawsuit against JP Morgan, according to Vito Torchia, Jr., managing attorney of Brookstone Law, PC, a leader in mass tort litigation consumer protection.

Brookstone Law recently filed, on behalf of over 60 plaintiffs, a mass tort lawsuit against JP Morgan Chase, Washington Mutual, EMC Mortgage and Bear Stearns alleging that executives at those banks knowingly steered homeowners into toxic adjustable rate or short term adjustable loans. The case is Potter vs. JP Morgan Chase, N.A., case no. BC459627, and was filed in the Central District of the Los Angeles Superior Court. The case parallels allegations described in media coverage of another lawsuit against JP Morgan filed by Ambac Assurance Corp.

“According to court documents, the depositions confirm that Bear Stearns and JP Morgan Chase were targeting California with dangerous loans, which is one of the reasons so many homeowners here are suffering,” said Vito Torchia, Jr. “Both banks’ executives knew the loans they were writing were dangerous yet, just as in their recent settlement over wrongful foreclosures of military families’ homes and as we allege in the suit against them, they were driven only by their balance sheets and in the process hurt thousands of homeowners.”

Media coverage of the lawsuit by mortgage insurer Ambac against Bear Stearns and JPMorgan that was recently unsealed made supporting e-mails public that show Bear Stearns traders telling their superiors they were selling investors like Ambac loan products that were a "sack of shit." According to media coverage, the lawsuit alleges that e-mails and internal audits also show JPMorgan, the nation’s second largest bank, had known about the fraud since 2008 but hid it from the public.

“These revelations clearly show how banks are responsible for many of the problems that caused the mortgage foreclosure crisis and care only about their profit margin,” said Vito Torchia, Jr. “Their treatment of their clients as evidenced by their internal emails was almost as disgusting as the fraud they are alleged to have committed.”

Read on.

Brookstone Law recently filed, on behalf of over 60 plaintiffs, a mass tort lawsuit against JP Morgan Chase, Washington Mutual, EMC Mortgage and Bear Stearns alleging that executives at those banks knowingly steered homeowners into toxic adjustable rate or short term adjustable loans. The case is Potter vs. JP Morgan Chase, N.A., case no. BC459627, and was filed in the Central District of the Los Angeles Superior Court. The case parallels allegations described in media coverage of another lawsuit against JP Morgan filed by Ambac Assurance Corp.

“According to court documents, the depositions confirm that Bear Stearns and JP Morgan Chase were targeting California with dangerous loans, which is one of the reasons so many homeowners here are suffering,” said Vito Torchia, Jr. “Both banks’ executives knew the loans they were writing were dangerous yet, just as in their recent settlement over wrongful foreclosures of military families’ homes and as we allege in the suit against them, they were driven only by their balance sheets and in the process hurt thousands of homeowners.”

Media coverage of the lawsuit by mortgage insurer Ambac against Bear Stearns and JPMorgan that was recently unsealed made supporting e-mails public that show Bear Stearns traders telling their superiors they were selling investors like Ambac loan products that were a "sack of shit." According to media coverage, the lawsuit alleges that e-mails and internal audits also show JPMorgan, the nation’s second largest bank, had known about the fraud since 2008 but hid it from the public.

“These revelations clearly show how banks are responsible for many of the problems that caused the mortgage foreclosure crisis and care only about their profit margin,” said Vito Torchia, Jr. “Their treatment of their clients as evidenced by their internal emails was almost as disgusting as the fraud they are alleged to have committed.”

Read on.

MERS Is Sued Over Michigan Foreclosures

Mortgage Electronic Registration Systems Inc. “illegally prosecuted” non-judicial foreclosures in Michigan and owes more than $100 million to people who lost their homes, lawyers for three homeowners said in a lawsuit.

The homeowners said Merscorp Inc.’s MERS, which runs an electronic registry of mortgages, used Michigan’s so-called foreclosure by advertisement process illegally and “misappropriated” their homes. Any foreclosures by MERS using this process in Michigan should be voided, they said in their complaint filed in federal court in Detroit.

Read on.

MI MERS Complaint w

The homeowners said Merscorp Inc.’s MERS, which runs an electronic registry of mortgages, used Michigan’s so-called foreclosure by advertisement process illegally and “misappropriated” their homes. Any foreclosures by MERS using this process in Michigan should be voided, they said in their complaint filed in federal court in Detroit.

Read on.

MI MERS Complaint w

Biloxi Buzz for Wednesday

Nearly Half Of Chicago Mortgages Are Underwater

Osama Bin Laden Son Missing From SEAL Raid, Pakistan Says — One of Osama bin Laden's sons went missing in the midst of the Navy SEAL raid that took the life of the al Qaeda leader more than a week ago, Pakistani security officials told ABC News today. — The officials said bin Laden's three wives …

Democrats to reintroduce DREAM Act — Senate Democrats will re-introduce the long-stalled DREAM Act, hoping to tap into momentum from President Barack Obama's speech along the border Tuesday about America's need to pass comprehensive immigration reform. — Senate Majority Leader Harry Reid …

Billionaire's role in hiring decisions at Florida State University raises questions — A conservative billionaire who opposes government meddling in business has bought a rare commodity: the right to interfere in faculty hiring at a publicly funded university.

Tuesday, May 10, 2011

A must read: A loophole to save your home from the banks

Here is the story:

But what your bank doesn't want you to know is this: you may be able to fight them - and win.

It happened for a Bakersfield couple who had purchased their dream home in a Salt Lake City suburb in 2007. Merrill and Laverne Chandler had planned to retire there but in the process lost their savings in the stock market.

"All of a sudden, it's gone. And that's not a good feeling," Merrill Chandler told NBCLA.

The couple is in their 70s now, Merrill is still working in a warehouse in Bakersfield - their dream home sitting in Herriman, Utah. For a while it was empty; for now there's a renter. Their story explains why.

Last March, Merrill and Laverne, with the help of their son, Merrill, Jr, fought their bank over the foreclosure and won a summary judgement. A Utah judge claiming the bank couldn't prove they owned the deed to the home, having sold it over and over on Wall Street, and therefore could not foreclose.

Merrill Chandler, Jr. was so moved by his parents' plight, he started the Nation Association of Foreclosure Defense Advocates (NAFDA), which now helps poeple understand their rights in the field of securitized mortgages and teaches attorneys to defend the homeowners in court.

Chandler, Jr. says when home prices peaked in 2006, it was the same time adjustable rate mortgages came due - higher home prices meant higher mortgages at refinancing time.

"What's happening in Southern California is that people who could afford a legitimate payment for the home they bought are being reset to higher payments and they can't afford those payments anymore," he said.

In a nutshell, the Chandler's mortgage was sold to an investment bank which spread the wealth to trustee firms which sold it to someone else and so on and so on - each entity making money on the mortgage - but leaving Merrill and Laverne with no clear answer as to who physically held the deed. The judge agreed.

"We were very fortunate," Chandler, Jr. said, "because the judge saw that the securitization process occurred and he wasn't aware of who the owner of the debt was."

In a summary judgment, the judge stated, "It does not appear the bank ... was the proper party to initiate default." The Utah house became what's called a "permanent possession" for the Chandlers.

“Basically tells us we can possess the property but we don’t own it," Merrill, Sr. explained.

There is a catch, though - if the Chandlers decide to sell, they still have to pay off the lein. But in the meantime, they don't have a mortgage to pay - only property taxes and a promise that someone will occupy the home. Hence, the renter - for now - they plan to finally move in by summer's end.

But what your bank doesn't want you to know is this: you may be able to fight them - and win.

It happened for a Bakersfield couple who had purchased their dream home in a Salt Lake City suburb in 2007. Merrill and Laverne Chandler had planned to retire there but in the process lost their savings in the stock market.

"All of a sudden, it's gone. And that's not a good feeling," Merrill Chandler told NBCLA.

The couple is in their 70s now, Merrill is still working in a warehouse in Bakersfield - their dream home sitting in Herriman, Utah. For a while it was empty; for now there's a renter. Their story explains why.

Last March, Merrill and Laverne, with the help of their son, Merrill, Jr, fought their bank over the foreclosure and won a summary judgement. A Utah judge claiming the bank couldn't prove they owned the deed to the home, having sold it over and over on Wall Street, and therefore could not foreclose.

Merrill Chandler, Jr. was so moved by his parents' plight, he started the Nation Association of Foreclosure Defense Advocates (NAFDA), which now helps poeple understand their rights in the field of securitized mortgages and teaches attorneys to defend the homeowners in court.

Chandler, Jr. says when home prices peaked in 2006, it was the same time adjustable rate mortgages came due - higher home prices meant higher mortgages at refinancing time.

"What's happening in Southern California is that people who could afford a legitimate payment for the home they bought are being reset to higher payments and they can't afford those payments anymore," he said.

In a nutshell, the Chandler's mortgage was sold to an investment bank which spread the wealth to trustee firms which sold it to someone else and so on and so on - each entity making money on the mortgage - but leaving Merrill and Laverne with no clear answer as to who physically held the deed. The judge agreed.

"We were very fortunate," Chandler, Jr. said, "because the judge saw that the securitization process occurred and he wasn't aware of who the owner of the debt was."

In a summary judgment, the judge stated, "It does not appear the bank ... was the proper party to initiate default." The Utah house became what's called a "permanent possession" for the Chandlers.

“Basically tells us we can possess the property but we don’t own it," Merrill, Sr. explained.

There is a catch, though - if the Chandlers decide to sell, they still have to pay off the lein. But in the meantime, they don't have a mortgage to pay - only property taxes and a promise that someone will occupy the home. Hence, the renter - for now - they plan to finally move in by summer's end.

View more videos at: http://www.nbclosangeles.com.

Northern MI Judge Throws Out Foreclosure Says Note Wasn’t Assigned By MERS

MFI-Miami:

An interesting ruling came down from the nether regions of Northern Michigan today. Houghton County Circuit Judge Charles Goodman ruled that a note holder lacked legal standing to execute both a foreclosure and the subsequent eviction because the originating lender Ameriquest only transferred their rights as mortgagee to MERS not their rights under the note. Therefore, because the mortgage and note have been separated and only the mortgage was assigned, the foreclosing entity, Household Finance who MERS assigned the mortgage to, lacked the legal standing to execute the foreclosure and eviction because they did not hold the promissory note.

The homeowners had initially lost their eviction in the 97th District Court (lower court in Michigan) and appealed it to the Hought County Circuit Court claiming Household Finance lacked legal standing because they were not the holder of the note. Judge Goodman not only overturned the eviction ruling from the District Court, he also invalidated the foreclosure and nullified the assignment from MERS to Household Finance.

An interesting ruling came down from the nether regions of Northern Michigan today. Houghton County Circuit Judge Charles Goodman ruled that a note holder lacked legal standing to execute both a foreclosure and the subsequent eviction because the originating lender Ameriquest only transferred their rights as mortgagee to MERS not their rights under the note. Therefore, because the mortgage and note have been separated and only the mortgage was assigned, the foreclosing entity, Household Finance who MERS assigned the mortgage to, lacked the legal standing to execute the foreclosure and eviction because they did not hold the promissory note.

The homeowners had initially lost their eviction in the 97th District Court (lower court in Michigan) and appealed it to the Hought County Circuit Court claiming Household Finance lacked legal standing because they were not the holder of the note. Judge Goodman not only overturned the eviction ruling from the District Court, he also invalidated the foreclosure and nullified the assignment from MERS to Household Finance.

Eviction of Milwaukee ex-Marine postponed for six months

Read the background of Keon Williams. Click here.

A six-month reprieve has been issued to Keon Williams, the north side man whose home was sold at a sheriff's sale in January even though he was current on the only mortgage he knew he had.

The agreement filed in Circuit Court on Monday between attorneys for Williams and attorneys for Harris Bank prevents the bank from concluding its purchase and evicting Williams from the N. 44th St. home until Nov. 12.

An earlier court order preventing completion of the sheriff's sale was to expire this week.

The delay provides time to try to resolve the mortgage issues swirling around Williams either through negotiations or court action.

Williams, whose dilemma was the subject of a Journal Sentinel report last month, has been teetering on the edge of eviction for months because he is caught in a vise created by the national mortgage meltdown and some fast dealings by the now-defunct Central States Mortgage Co. and an affiliated company.

NEW REPORT: Foreclosing on Ohio – Big Bank Foreclosures in Cincinnati, Cleveland, and Columbus

Ohio is one of the hardest hit states in the nation by the foreclosure crisis. While the Buckeye State has not posted the shear volumes of foreclosures as the once-hot housing markets of California Nevada and Florida, the cumulative impact of foreclosures have weighed heavily on Ohio’s housing market and its economy. Ohio is currently ranked as the 9th highest state in terms of total foreclosure activity and third highest in the Midwest b ehind economically struggling Michigan and Illinois.

However, current foreclosure activity rates fail to capture the cumulative impacts of sustained foreclosure activity in the state. The fact is that the foreclosure crisis started early in Ohio and the state now has endured elevated levels of home foreclosure for over half a decade. In 2006, Ohio experienced a sizable 23.6% increase in annual home foreclosure filings and the numb er of filings have continued at a historically-high rate of over 80,000 filings per year.

To check out the reports major findings click here…

However, current foreclosure activity rates fail to capture the cumulative impacts of sustained foreclosure activity in the state. The fact is that the foreclosure crisis started early in Ohio and the state now has endured elevated levels of home foreclosure for over half a decade. In 2006, Ohio experienced a sizable 23.6% increase in annual home foreclosure filings and the numb er of filings have continued at a historically-high rate of over 80,000 filings per year.

To check out the reports major findings click here…

In Fine Print, Banks Require Struggling Homeowners to Waive Rights

A few months ago, Bank of America offered Sergio Cortez of Staten Island, N.Y., the help he desperately needed to stay in his home: a break on his mortgage. Like millions of others, he was facing foreclosure. But there was a catch buried in the fine print. Cortez had to waive any possibility of ever suing the bank for anything relating to the loan.

Cortez isn't alone. While regulators have banned the practice, some banks and others who handle mortgages have still been forcing homeowners into a corner: You want a chance at saving your home? Then you'll have to waive your rights.

"It's just unfair," said Jane Azia, director of consumer protection for the New York State Banking Department. "It puts borrowers in a very vulnerable situation."

We identified eight banks and other mortgage servicers who offer help that limits homeowners' ability to sue or fight foreclosure. When we contacted them, they offered a variety of responses. Some said the inclusion of the waivers had been a mistake and would stop. Some argued that language that seemed to waive the homeowner's rights didn't actually do so. One argued that a loophole in a rule barring the practice meant their inclusion in certain agreements was proper.

Read on.

Bank of America, the country's largest servicer, included similar language in agreements late last year not only in New York, but several other states.

It's not a new practice for Bank of America. Back in July 2008, Rep. Waters confronted Bank of America executive Michael Gross over the practice during a congressional hearing. When Gross said he wasn't aware that the bank had ever required that borrowers waive their rights, Rep. Waters read out an excerpt from a Countrywide agreement. Bank of America had bought Countrywide that year.

After hearing the excerpt, Gross apologized and promised the issue would "be under review by Bank of America very quickly."

But ProPublica spoke to attorneys in New York, Maine, Connecticut, Indiana and North Carolina who received agreements with waiver clauses from Bank of America in the last year. In four cases, the clause was word-for-word the same as the one discussed in the 2008 hearing, a lengthy paragraph involving a release of all of Bank of America's "investors, employees and related companies from any and all claims." [13]

Bank of America's language even waives the right to invoke a California law that limits the scope of waiver clauses, "so that this release shall include all and any claims whatsoever of every nature concerning the loan."

Click here to view Bank of America forebearance agreement which include waiver agreement.

Brown argued the language in the clause "is not a waiver" because it did not expressly waive the borrower's rights.

Banks are being unfair to homeowners without legal representation.

Cortez isn't alone. While regulators have banned the practice, some banks and others who handle mortgages have still been forcing homeowners into a corner: You want a chance at saving your home? Then you'll have to waive your rights.

"It's just unfair," said Jane Azia, director of consumer protection for the New York State Banking Department. "It puts borrowers in a very vulnerable situation."

We identified eight banks and other mortgage servicers who offer help that limits homeowners' ability to sue or fight foreclosure. When we contacted them, they offered a variety of responses. Some said the inclusion of the waivers had been a mistake and would stop. Some argued that language that seemed to waive the homeowner's rights didn't actually do so. One argued that a loophole in a rule barring the practice meant their inclusion in certain agreements was proper.

Read on.

Bank of America, the country's largest servicer, included similar language in agreements late last year not only in New York, but several other states.

It's not a new practice for Bank of America. Back in July 2008, Rep. Waters confronted Bank of America executive Michael Gross over the practice during a congressional hearing. When Gross said he wasn't aware that the bank had ever required that borrowers waive their rights, Rep. Waters read out an excerpt from a Countrywide agreement. Bank of America had bought Countrywide that year.

After hearing the excerpt, Gross apologized and promised the issue would "be under review by Bank of America very quickly."

But ProPublica spoke to attorneys in New York, Maine, Connecticut, Indiana and North Carolina who received agreements with waiver clauses from Bank of America in the last year. In four cases, the clause was word-for-word the same as the one discussed in the 2008 hearing, a lengthy paragraph involving a release of all of Bank of America's "investors, employees and related companies from any and all claims." [13]

Bank of America's language even waives the right to invoke a California law that limits the scope of waiver clauses, "so that this release shall include all and any claims whatsoever of every nature concerning the loan."

Click here to view Bank of America forebearance agreement which include waiver agreement.

Brown argued the language in the clause "is not a waiver" because it did not expressly waive the borrower's rights.

Banks are being unfair to homeowners without legal representation.

Biloxi Buzz for Tuesday

U.S. And Pakistan Reportedly Made Secret Deal On Bin Laden Mission 10 Years Ago

Bair to leave FDIC in July

Arnold Schwarzenegger, Maria Shriver announce separation — The former first lady has moved out after 25 years of marriage. Maria Shriver helped bolster Arnold Schwarzenegger's campaign against charges that he groped women during his movie career. — Arnold Schwarzenegger and Maria Shriver …

OOPS! State Lawmakers Miss Unemployment Benefits Deadline, Now Want A Do-Over

Amtrak, 15 States Get High-Speed Rail Funds That Florida Lost

Bair to leave FDIC in July

Gingrich Set to Run, With Wife in Central Role — WASHINGTON — Callista Bisek's friends from rural Wisconsin were stunned when, well over a decade ago, she confided that she was secretly dating an older, married man: Newt Gingrich. — Still in her 20s when they met …

CA Judge Rules for BofA; BofA Does Not Automatically Carry Successor Liability for Countrywide

A California federal judge dismissed all claims that investors, who bought mortgage-backed securities (MBS) from Countrywide, brought against Bank of America The claims were for purchases made with Countrywide before BofA bought the subprime lender. In essence, the judge was saying Bank of America is not liable for Countrywide’s MBS deals.

The lawsuit was a second attempt by these pension fund investors to sue BofA. The original claims about $352 billion in mortgage bonds were also unsuccessful.

According to online legal news site Law360, the judge granted Bank of America’s dismissal request because the plaintiffs failed to show that two separate transactions between the bank and Countrywide involving the transferring of assets mean a de facto merger. BofA is therefore protected from successor liability.

The lawsuit was a second attempt by these pension fund investors to sue BofA. The original claims about $352 billion in mortgage bonds were also unsuccessful.

According to online legal news site Law360, the judge granted Bank of America’s dismissal request because the plaintiffs failed to show that two separate transactions between the bank and Countrywide involving the transferring of assets mean a de facto merger. BofA is therefore protected from successor liability.

Very interesting court decision. BofA claims there is no successor interest from Countrywide in regards to investors and RMBS. This would mean that anyone who had a Countrywide home loan has no more obligation. BofA just cut their own throat….http://shortsaledailynews.com/california-judge-rules-for-bank-of-america

Half of Fannie Mae mortgages registered in MERS name

Roughly half of the mortgages owned or guaranteed by Fannie Mae are registered in the Mortgage Electronic Registration Systems name, according to a filing by the government-sponsored enterprise last week.

Fannie's guaranty book of business totaled $2.9 trillion at the end of the first quarter, meaning about $1.45 trillion of loans are registered in MERS' name. The connection, Fannie said, poses a significant risk.

Privately held MERS, which was built by the GSEs and the nation's major lenders in the 1990s, is an electronic registry that tracks servicing rights and ownership of loans from origination through securitization. MERS serves as a nominee for the owner of a mortgage and therefore becomes the mortgagee of record for the loan in local land records.

Read on.

Fannie's guaranty book of business totaled $2.9 trillion at the end of the first quarter, meaning about $1.45 trillion of loans are registered in MERS' name. The connection, Fannie said, poses a significant risk.

Privately held MERS, which was built by the GSEs and the nation's major lenders in the 1990s, is an electronic registry that tracks servicing rights and ownership of loans from origination through securitization. MERS serves as a nominee for the owner of a mortgage and therefore becomes the mortgagee of record for the loan in local land records.

Read on.

Mortgage investors zeroing in on subprime lender

(Reuters) – A group of mortgage bond investors is reaching out for help in a novel bid to force H&R Block Inc’s defunct subprime lending unit to buy back billions of dollars in soured mortgages, the group’s lawyer said on Monday.

The plea to other bond investors may hasten the laborious task of gathering the numbers needed to demand accountability for faulty loans pooled into investments — mortgage-related securities that plummeted in value and helped trigger the worst financial crisis since the 1930s.

The investors, in a new tactic, are issuing a general call to others holding securities backed by loans originated by Option One Mortgage, a top 10 subprime lender during the housing boom, said Talcott Franklin, the Dallas-based lawyer spearheading the effort.

The plea to other bond investors may hasten the laborious task of gathering the numbers needed to demand accountability for faulty loans pooled into investments — mortgage-related securities that plummeted in value and helped trigger the worst financial crisis since the 1930s.

The investors, in a new tactic, are issuing a general call to others holding securities backed by loans originated by Option One Mortgage, a top 10 subprime lender during the housing boom, said Talcott Franklin, the Dallas-based lawyer spearheading the effort.

Check out the rest here…

Monday, May 09, 2011

Insurance Fraud 101

From OperationLeakS:

Written by ExBofAEmployee1

It’s time to take a look at the basics of insurance forms so you can understand how it is the banksters commit fraud and charge you erroneous premiums. Whether you have a bank loan for a house, condo, mobile home, townhouse, automobile, farm/commercial equipment, or a commercial property, you are required by the terms of your loan to carry insurance of some type. The Acord form may look familiar to you:

This point is where the majority of the insurance fraud by your bank against you occurs. Here’s how:

A Deletion of Interest is printed on a cancellation form, and is therefore treated by the loan servicer as a cancellation.

If you paid close attention to the rules above, the LPI policy that is forced on your account and charged to you is often backdated regardless of whether or not you have a loss.This is a highly illegal practice that will actually be documented on the force placed letter you receive from the loan servicer.

A Deletion of Interest is sent to your bank in the following scenarios (the majority of which are completely out of your control):

Your Lienholder sells your loan to investors

Your Lienholder sells the servicing rights of your loan to a loan servicer

You pay off your loan and file a certificate of lien release

Your Lienholder/Loan Servicer changes processing center addresses or PO boxes

Your Lienholder is bought by another bank

As you can see, without any intervention, miscalculation, or mistake on your part in any way, the banking and insurance regulations set for your bank have now caused your escrow account (whether pre-existing or not) to become negative, even if you already paid off your loan, due entirely to circumstances created by your bank. This occurs tens of thousands of times every single day in our country to honest and hardworking American citizens, causing many to have their home, vehicle, or investment property taken away from them illegally by the bank.

If you are in the position where you may lose (or may have already lost) your property, whether home, auto, or commercial, study any correspondence you have received from your bank. You may have the system-generated written proof of their fraudulent and illegal (per the Gramm-Leach-Bliley Act) activities already in your hand in the form of a force placed policy notification form where the effective date of the policy is older than the print date of the letter itself. Bring this to the attention of an attorney immediately.

Written by ExBofAEmployee1

It’s time to take a look at the basics of insurance forms so you can understand how it is the banksters commit fraud and charge you erroneous premiums. Whether you have a bank loan for a house, condo, mobile home, townhouse, automobile, farm/commercial equipment, or a commercial property, you are required by the terms of your loan to carry insurance of some type. The Acord form may look familiar to you:

This point is where the majority of the insurance fraud by your bank against you occurs. Here’s how:

A Deletion of Interest is printed on a cancellation form, and is therefore treated by the loan servicer as a cancellation.

If you paid close attention to the rules above, the LPI policy that is forced on your account and charged to you is often backdated regardless of whether or not you have a loss.This is a highly illegal practice that will actually be documented on the force placed letter you receive from the loan servicer.

A Deletion of Interest is sent to your bank in the following scenarios (the majority of which are completely out of your control):

Your Lienholder sells your loan to investors

Your Lienholder sells the servicing rights of your loan to a loan servicer

You pay off your loan and file a certificate of lien release

Your Lienholder/Loan Servicer changes processing center addresses or PO boxes

Your Lienholder is bought by another bank

As you can see, without any intervention, miscalculation, or mistake on your part in any way, the banking and insurance regulations set for your bank have now caused your escrow account (whether pre-existing or not) to become negative, even if you already paid off your loan, due entirely to circumstances created by your bank. This occurs tens of thousands of times every single day in our country to honest and hardworking American citizens, causing many to have their home, vehicle, or investment property taken away from them illegally by the bank.

If you are in the position where you may lose (or may have already lost) your property, whether home, auto, or commercial, study any correspondence you have received from your bank. You may have the system-generated written proof of their fraudulent and illegal (per the Gramm-Leach-Bliley Act) activities already in your hand in the form of a force placed policy notification form where the effective date of the policy is older than the print date of the letter itself. Bring this to the attention of an attorney immediately.

Sanctions to Citi following case of former Indonesia employee committing fraud

(Reuters) - Citibank (C.N) said a former employee had committed fraud in Indonesia and sought to reassure card clients on Saturday, a day after the central bank slapped lengthy bans on its credit card and wealth management businesses.

The sanctions came as Indonesian police investigate both the death of a Citi credit card client following questioning by debt collectors and a case of alleged embezzlement of around $2 million in its wealth management business.

Citi, which has previously only said it uncovered suspicious transactions, sent a letter to credit card holders on Saturday aimed at keeping them onboard, saying it had taken corrective action and the suspensions would not impact clients.

"We regret the two recent incidents involving the tragic passing of a credit card customer and the unacceptable fraudulent actions of a former employee," said Citi country officer Shariq Mukhtar in the letter.

"We are committed to restoring public trust in our franchise."

Read on.

And...

An Indonesian woman has filed a civil suit against Citi seeking $347 million in damages, after her husband died on March 29 following questioning over bills on a Citi credit card.

Indonesia's central bank barred Citigroup's local unit from adding new credit card clients for two years and new customers for its premium wealth service for a year starting May 6. It said if the police found crimes were committed, it would revoke the bank's operating license.

The sanctions came as Indonesian police investigate both the death of a Citi credit card client following questioning by debt collectors and a case of alleged embezzlement of around $2 million in its wealth management business.

Citi, which has previously only said it uncovered suspicious transactions, sent a letter to credit card holders on Saturday aimed at keeping them onboard, saying it had taken corrective action and the suspensions would not impact clients.

"We regret the two recent incidents involving the tragic passing of a credit card customer and the unacceptable fraudulent actions of a former employee," said Citi country officer Shariq Mukhtar in the letter.

"We are committed to restoring public trust in our franchise."

Read on.

And...

An Indonesian woman has filed a civil suit against Citi seeking $347 million in damages, after her husband died on March 29 following questioning over bills on a Citi credit card.

Indonesia's central bank barred Citigroup's local unit from adding new credit card clients for two years and new customers for its premium wealth service for a year starting May 6. It said if the police found crimes were committed, it would revoke the bank's operating license.

Biloxi Buzz for Monday

Michelle Obama Praises SEALs in Commencement Speech

Osama Bin Laden Aided by Rogue or Retired Elements of Pakistani Intelligence, Government Official Says — A senior official in Pakistan's civilian government told ABC News, “Elements of Pakistan intelligence — probably rogue or retired — were involved in aiding, abetting and sheltering …

CNN Exclusive: Alleged rape victim flees Libya — (CNN) — Eman al-Obeidy, who garnered worldwide attention for her vocal rape allegations against the regime of Moammar Gadhafi, says she has fled Libya, fearing for her safety. — Al-Obeidy told CNN that she crossed into Tunisia on Thursday …

Florida Bill Could Muzzle Doctors On Gun Safety

Now, to Find a Parking Spot, Drivers Look on Their Phones

Last week's poll had asked:

Did you celebrate or avoid watching the royal wedding of Prince William and Kate Middleton? JL readers answered that they avoid watching the wedding. This week's poll is now up.

Osama Bin Laden Aided by Rogue or Retired Elements of Pakistani Intelligence, Government Official Says — A senior official in Pakistan's civilian government told ABC News, “Elements of Pakistan intelligence — probably rogue or retired — were involved in aiding, abetting and sheltering …

CNN Exclusive: Alleged rape victim flees Libya — (CNN) — Eman al-Obeidy, who garnered worldwide attention for her vocal rape allegations against the regime of Moammar Gadhafi, says she has fled Libya, fearing for her safety. — Al-Obeidy told CNN that she crossed into Tunisia on Thursday …

Florida Bill Could Muzzle Doctors On Gun Safety

Now, to Find a Parking Spot, Drivers Look on Their Phones

Last week's poll had asked:

Did you celebrate or avoid watching the royal wedding of Prince William and Kate Middleton? JL readers answered that they avoid watching the wedding. This week's poll is now up.

Banks' worse nightmare: Forged Register of Deeds docs ; Part 1

Written by Biloxi

If the banks think that the housing crisis, 50 state Attorneys General investigation, robo-signing scandals, violating the servicemember federal law, federal agencies foreclosure investigations, etc. are worse, think again. Much of the media haven't paid attention to real nightmare for the banks: Forging of the assignment of mortgages in the Registrar of Deeds in all 50 states. And there are some Register of Deeds heads that are not only finding fraudulent mortgage documents recorded, but they are requesting a criminal investigation into the fraud.

Last year, Essex County Register of Deeds John O’Brien in Massachusetts had sent a letter to state Attorney General Martha Coakley to request Ms. Coakley to investigate whether or not the Mortgage Electronic Registration Systems, Inc. (MERS) has failed to pay the recording fees. Mr. O'Brien began to question the assignment of mortgages recorded since a number of court filings in different states alleged that MERS intentionally failed to pay recording fees:

O’Brien said that it had come to his attention that a number of states have alleged in court filings that MERS intentionally failed to pay recording fees, and failed to disclose the transfer and assignments of interest in property, solely to avoid and decrease the recordation fees owed to the counties and the state.

In addition, MERS may have wrongfully bypassed Massachusetts recording requirements, thereby frustrating the borrower’s right to know the true identity of the holder of his or her mortgage, according to O’Brien.

Moreover, other Registrar of Deeds in other states is investigating fraudulent mortgage document recordings. This year in Michigan, Ingham County Register of Deeds Curtis Hertel found numerous cases of mortgage fraud recordings:

Three signatures all read Linda Green, Vice President. Her name shows up on at least 60 home mortgage documents in Ingham Count, but none of them look the same.

Curtis Hertel: "If you look at the signatures, it's amazing that they thought they could get away with this."

Ingham County Register of Deeds Curtis Hertel says they're forged and are the work of some of the nations biggest banks who've used phony documents to speed up the foreclosure process, so instead of paying 17 bucks to file the forms, Hertel says those banks paid employees to sign names like Green and Tywanna Thomas as a shortcut.

In the state of Michigan, fraudulent mortgage and title documents recorded is a felony. Now, both the Ingham County Sheriff’s Department and the FBI is investigating this. And this week, Michigan county clerks testified at House Banking and Financial Services Committee in the state regarding Oakland County Clerk/Register of Deeds Bill Bullard Jr.'s investigation into fraudulent signatures on foreclosure documents:

Bullard's investigation uncovered signatures on foreclosure documents filed in Oakland County in 2008 and 2009 which matched a national pattern of signatures by a nonexistent bank "Vice President, Linda Green."

In the state of North Carolina, Guilford County Register of Deeds Jeff Thigpen had uncovered more than 4,500 documents of forged or altered signatures by mortgage lenders such as Bank of America and Wells Fargo. Even Mr. Thigpen created a spreadsheet of all the names and property addresses of homeowners affected from the fraudulent mortgage documents and the name of the mortgage lenders. Click here. And thanks to Mr. Thigpen, Guilford County Attorney Mark Payne will talk with the county commissioners about taking legal action.

This news gets grimmer for the banks. So stay tuned.

If the banks think that the housing crisis, 50 state Attorneys General investigation, robo-signing scandals, violating the servicemember federal law, federal agencies foreclosure investigations, etc. are worse, think again. Much of the media haven't paid attention to real nightmare for the banks: Forging of the assignment of mortgages in the Registrar of Deeds in all 50 states. And there are some Register of Deeds heads that are not only finding fraudulent mortgage documents recorded, but they are requesting a criminal investigation into the fraud.

Last year, Essex County Register of Deeds John O’Brien in Massachusetts had sent a letter to state Attorney General Martha Coakley to request Ms. Coakley to investigate whether or not the Mortgage Electronic Registration Systems, Inc. (MERS) has failed to pay the recording fees. Mr. O'Brien began to question the assignment of mortgages recorded since a number of court filings in different states alleged that MERS intentionally failed to pay recording fees:

O’Brien said that it had come to his attention that a number of states have alleged in court filings that MERS intentionally failed to pay recording fees, and failed to disclose the transfer and assignments of interest in property, solely to avoid and decrease the recordation fees owed to the counties and the state.

In addition, MERS may have wrongfully bypassed Massachusetts recording requirements, thereby frustrating the borrower’s right to know the true identity of the holder of his or her mortgage, according to O’Brien.

Moreover, other Registrar of Deeds in other states is investigating fraudulent mortgage document recordings. This year in Michigan, Ingham County Register of Deeds Curtis Hertel found numerous cases of mortgage fraud recordings:

Three signatures all read Linda Green, Vice President. Her name shows up on at least 60 home mortgage documents in Ingham Count, but none of them look the same.

Curtis Hertel: "If you look at the signatures, it's amazing that they thought they could get away with this."

Ingham County Register of Deeds Curtis Hertel says they're forged and are the work of some of the nations biggest banks who've used phony documents to speed up the foreclosure process, so instead of paying 17 bucks to file the forms, Hertel says those banks paid employees to sign names like Green and Tywanna Thomas as a shortcut.

In the state of Michigan, fraudulent mortgage and title documents recorded is a felony. Now, both the Ingham County Sheriff’s Department and the FBI is investigating this. And this week, Michigan county clerks testified at House Banking and Financial Services Committee in the state regarding Oakland County Clerk/Register of Deeds Bill Bullard Jr.'s investigation into fraudulent signatures on foreclosure documents:

Bullard's investigation uncovered signatures on foreclosure documents filed in Oakland County in 2008 and 2009 which matched a national pattern of signatures by a nonexistent bank "Vice President, Linda Green."

In the state of North Carolina, Guilford County Register of Deeds Jeff Thigpen had uncovered more than 4,500 documents of forged or altered signatures by mortgage lenders such as Bank of America and Wells Fargo. Even Mr. Thigpen created a spreadsheet of all the names and property addresses of homeowners affected from the fraudulent mortgage documents and the name of the mortgage lenders. Click here. And thanks to Mr. Thigpen, Guilford County Attorney Mark Payne will talk with the county commissioners about taking legal action.

This news gets grimmer for the banks. So stay tuned.

Banks' worst nightmare: Commercial mortgage backed securities; Part 2

Written by Biloxi

In a part 2 series, commerical mortgage backed securities has been less focused in the media. Residential housing is not the only major concern for the banks. Delinquency rate has risen in commercial mortgage backed securities (CMBS) as predicted from Congressional Oversight Panel (COP) report last year. Here is CNBC's report on the CMBS market:

After two months of very minimal rate increases, the number jumped in April, 23 basis points, to 9.65 percent, "the highest reading in the history of the CMBS market," according to Trepp.

To say the recovery is, as the report notes, "bumpy," is putting it mildly. The rate should be going down for two reasons: