Americablog:

But that's OK because Dick Cheney says the US economy is very resilient. He's been pretty much spot on about everything and what do they know at Goldman Sachs anyway? (Hint: Goldman is holding up OK since they didn't join the subprime hysteria.)

In a year when Wall Street bonuses are forecast to fall 10 to 15 percent, payouts will climb at Goldman Sachs.

Last year, Goldman accounted for $16.5 billion of the $36 billion dollars Wall Street's top five brokerages dished out to employees around the world. This year, that number is seen rising at least 22 percent.

In a year when Wall Street bonuses are forecast to fall 10 to 15 percent, payouts will climb at Goldman Sachs.

Last year, Goldman accounted for $16.5 billion of the $36 billion dollars Wall Street's top five brokerages dished out to employees around the world. This year, that number is seen rising at least 22 percent.

"This year we estimate the bonus pool should be $38 billion dollars out of which $20 billion plus is going to be with Goldman Sachs in their bonus pool," said Michael Karp, CEO of the executive search firm Options Group.

In what compensation consultants are calling an "aberrant" year for Wall Street pay, Options Group says payouts will vary greatly from firm to firm, and from division to division within those firms. You can blame the credit crunch for the disparity.

When it erupted this summer, Wall Street was on track to post another year of record profits. Goldman remains on that track thanks to the bets it made against mortgages and mortgage related securities. Other firms didn't, and as a result, Goldman rivals like Merrill Lynch, Bear Stearns and Morgan Stanley face multibillion dollar writedowns, while some of their employees face smaller bonuses.

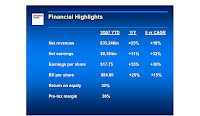

Here is the Goldman Sachs Presentation at the 2007 Merrill Lynch Banking and Financial Services Investor Conference slides:

1 comment:

Smart move on Goldeman Sachs's part. Let the other companies get weak enought for a take over. The only problem is the Middle East might sneek in and take Goldman Sachs in the end. It's called the player got played.

Post a Comment